A tool for creating underwriting applications that streamline and automate the underwriting process, improving efficiency and accuracy.

The Underwriting Solutions by OutSystems enables insurers to create sophisticated underwriting applications that streamline and automate complex processes. These solutions can integrate with existing systems and data sources to provide underwriters with a comprehensive view of risk. Features may include automated risk assessment, integration with external data providers, workflow management, and decision support tools. By improving underwriting efficiency and accuracy, insurers can make better-informed decisions, reduce risk, and potentially improve profitability.

Feature List

- Automated claims routing

- Fraud detection algorithms

- Document management

- Payment system integration

- Workflow automation

- Customer communication tools

- Performance analytics

Use Case Scenarios

- A commercial insurer could use the solution to automate underwriting for small business policies, reducing turnaround times.

- A life insurance company could integrate external health data sources to improve risk assessment accuracy.

- An auto insurer could implement a rules engine to ensure consistent underwriting decisions across different regions.

Functionality Overview

Underwriting Solutions function as a comprehensive platform for managing the risk assessment and policy issuance process. The system typically starts by ingesting application data, either through integration with front-end systems or manual input. It then applies predefined underwriting rules and leverages external data sources to assess risk. For straightforward cases, the system can make automated decisions. For more complex risks, it provides underwriters with a workbench containing all relevant information and decision support tools. Throughout the process, the system maintains compliance checks and generates necessary documentation.

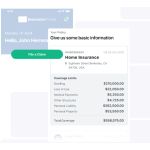

Screenshot

Demo Video