A template for rapid deployment of product launch and quote-and-buy experiences, improving time-to-market for application-based insurance offerings.

The D2C Product Launch, Quote & Buy Template is designed to help insurers rapidly configure and deploy new insurance products with an integrated quote-and-buy experience. It offers real-time integration with leading platforms and enables the creation of engaging user interfaces across all devices. This template aims to significantly reduce time-to-market for application-based insurance offerings, allowing insurers to respond quickly to market demands and customer needs. Its customizable nature ensures that insurers can tailor the experience to their specific products and brand identity.

Feature List

- Rapid product configuration

- Real-time platform integration

- Multi-device user interface

- Customizable branding

- Quote generation

- Policy issuance

- Application-based offerings

Use Case Scenarios

- An insurer could use the template to quickly launch a new digital-only insurance product, reducing time-to-market.

- A traditional insurer could leverage the template to create a modern, user-friendly quote-and-buy experience for their existing products.

- An InsurTech startup could use the template as a foundation to build and test innovative insurance offerings rapidly.

Functionality Overview

The D2C Product Launch, Quote & Buy Template functions as a comprehensive platform for digital insurance product deployment. It likely begins with a product configuration module where insurers can define coverage options, pricing rules, and underwriting criteria. The template then generates a user-friendly interface for customers to input their information and receive quotes. It integrates with backend systems for real-time pricing and risk assessment. Once a quote is accepted, the system facilitates policy issuance and payment processing. Throughout the process, the template likely provides analytics and reporting capabilities to help insurers optimize their offerings and customer experience.

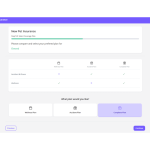

Screenshot

Demo Video

App Related Tags